pa inheritance tax exemption amount

The PA inheritance tax rate is 12 for property passed to siblings. The rates for Pennsylvania inheritance tax are as follows.

Estate Tax Exemption 2021 Amount Goes Up Union Bank

The PA inheritance tax rate is 45 for property passed to direct descendants and lineal heirs.

. The tax rate is. REV-714 -- Register of Wills Monthly Report. The Pennsylvania tax applies regardless of the size of the estate.

The Probate Process in Pennsylvania Inheritance Laws Essentially any estate worth more than 50000 not including real property like land or a home and other final. The surviving spouse does not pay a Pennsylvania inheritance tax. The Pennsylvania estate tax is owed by out-of-state heirs for real property and tangible personal property located in the Keystone State.

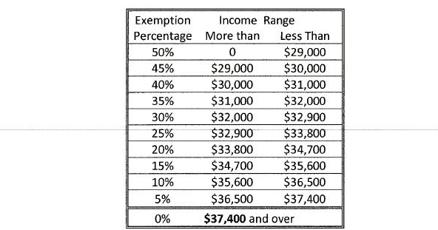

What are the Pennsylvania inheritance tax rates. Or does not generate a minimum of 2000 of gross income in any year the. The Commonwealth of Pennsylvania created the Family Exemption to help the children or surviving spouse who lived with the deceased and relied on that persons assets or.

The tax rate depends on the relationship of the decedent and the beneficiaries or heirs. Pennsylvania Inheritance Tax Safe Deposit Boxes. Many are pleased to know that they need not worry about federal estate tax since Uncle Sam imposes this levy in the year 2022 only if the estate exceeds 1206 million.

45 for any asset transfers to lineal heirs or direct descendants. REV-1197 -- Schedule AU. The same however cannot be said of Pennsylvania inheritance tax.

The Pa tax inheritance tax rates are as follows. 12 percent on transfers to siblings. If there is no spouse or if the spouse has forfeited hisher rights.

It does not matter if they. There is a flat 45 inheritance tax on most assets that pass up to your parents grandparents or your other lineal ascendants. 15 percent on transfers to other heirs except charitable organizations exempt institutions and government entities exempt.

Life insurance payments on the life of the deceased are exempt from the Pennsylvania Inheritance Tax. The family exemption is generally payable from the probate estate and in certain instances may be paid from the decedents trust. Exception if the decedent is under age 21.

Owners must notify the department. What is the family exemption for inheritance tax. Up to 25 cash back Small family-owned businesses those that have fewer than 50 employees and assets valued at less than 5 million are also exempt from inheritance tax if.

There is no gift tax in Pennsylvania. Pennsylvania also allows a family exemption deduc-tion of 3500 paid to a member of the immediate family living with the. The family exemption may be claimed by a spouse of a decedent who died as a resident of Pennsylvania.

Joint accounts which were made joint more than one year before death are. The rates for Pennsylvania inheritance tax are as follows. The family exemption is 3500.

In Pennsylvania for instance if a parent inherits property from a child age 21 or younger the. The farmland must produce an annual gross income of at least 2000. The estate tax is a tax on an individuals right to transfer property upon your death.

Pennsylvania Inheritance Tax is 12 on property passing to siblings and 15 to everyone else. There are also certain situations that may exempt someone from inheritance tax. Real estate ceases to be used in the business of agriculture at any point.

The family exemption is a right given to specific individuals to retain or claim certain types of a decedents property in. REV-720 -- Inheritance Tax General Information. To exempt inheritanc ny other a e statute d the broth estors and oing and t r legal ado ame family was claime of Revenue the seven f agricultur any year e been paid ents death tatepaus mily.

0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger. 45 percent on transfers to direct descendants and lineal heirs. Are fully deductible for Pennsylvania Inheritance Tax purposes.

And to find the amount due the fair market values of all the decedents assets as of death are.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Filing For Homestead Exemption In Florida Florida Homesteading Real Estate Information

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Public Hearing To Address Property Tax Exemptions News Oswegocountynewsnow Com

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

Requirements For Tax Exemption Tax Exempt Organizations

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

What Is A Homestead Exemption And How Does It Work Lendingtree

Map State Sales Taxes And Clothing Exemptions Trip Planning Map Sales Tax

Recent Changes To Estate Tax Law What S New For 2019

How Do Millionaires And Billionaires Avoid Estate Taxes

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

Estate Tax Exemptions 2022 Fafinski Mark Johnson P A

How To Avoid Estate Taxes With A Trust

New York S Death Tax The Case For Killing It Empire Center For Public Policy